Financial wellness isn't just a nice to have. It's a critical component of your benefits and total rewards package. But not all financial wellness advisors or programs are created equal.

While you might have offered webinars or free training provided by a retirement plan or your EAP provider, which are great steps to take, there are limitations to these options. Many times programs offered through free resources or retirement plans only address one of the five areas of personal finances. With an independent provider like Pathwise Financial Wellness, employees get holistic financial support.

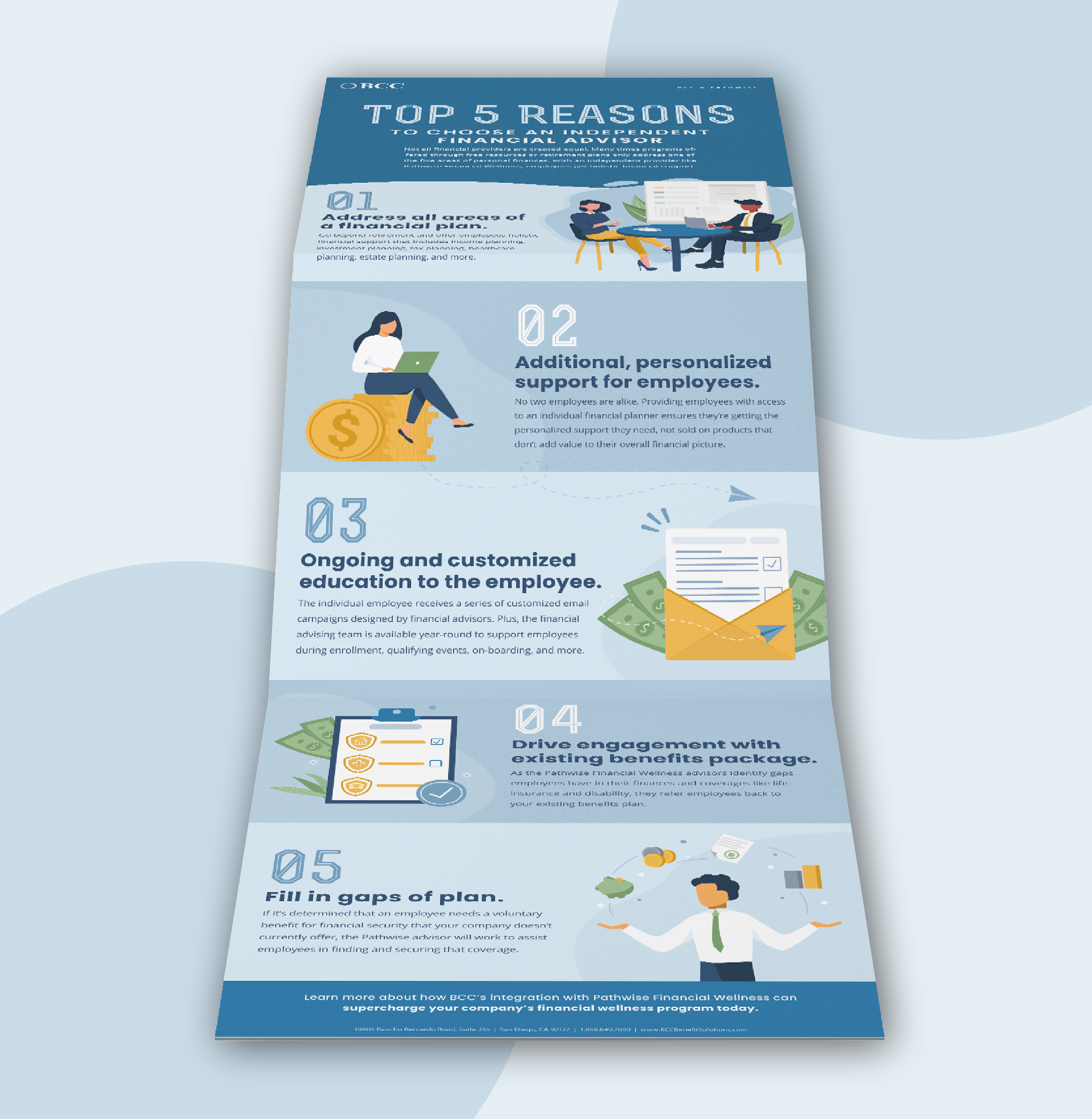

Here are the top 5 reasons to choose an independent financial advisor:

- Address all areas of a financial plan.

Go beyond retirement and offer employees holistic financial support that includes income planning,

investment planning, tax planning, healthcare planning, estate planning, and more.

- Additional, personalized support for employees.

No two employees are alike. Providing employees with access to an individual financial planner ensures they’re getting the personalized support they need, not sold on products that don’t add value to their overall financial picture.

- Ongoing and customized education to employees.

Employees receive a series of customized email campaigns designed by financial advisors. Plus, the financial advising team is available year-round to support employees during enrollment, qualifying events, on-boarding, and more.

- Drive engagement with existing benefits package.

As the Pathwise Financial Wellness advisors identify gaps employees have in their finances and coverages like life insurance and disability, they refer employees back to your existing benefits plan.

- Close gaps in benefits plan.

If it’s determined that an employee needs a voluntary benefit for financial security that your company doesn’t currently offer, the Pathwise advisor will work to assist employees in finding and securing that coverage.

BCC's integration with Pathwise Financial means you can offer a robust financial wellness program to your employees at pivotal financial moments in their lives, directly from the BenXcel system.

Lean more about how to enhance benefits, increase employee engagement with your benefits program, and save your HR team time with BCC's integration with Pathwise Financial Wellness.

Download these tips and more in a PDF that is ready to share with your decision-making team!